Wage & Tax Information

Form W-4

You must complete Form W-4 so the Payroll Department can calculate the correct amount of tax to withhold from your pay. Federal income tax is withheld based on your biweekly taxable wages and what you claim on your W4 form. You may also specify that an additional dollar amount be withheld. You can file a new Form W-4 anytime your tax situation changes. Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

You must complete Form W-4 so the Payroll Department can calculate the correct amount of tax to withhold from your pay. Federal income tax is withheld based on your biweekly taxable wages and what you claim on your W4 form. You may also specify that an additional dollar amount be withheld. You can file a new Form W-4 anytime your tax situation changes. Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

Updating your Form W-4 Online

- Login to MyFIU.

- Navigate to: Employee Self Service > Payroll Tile > W-4 Tax Information.

- Complete the requested Security Check Questions and click “Submit.”

- Update your Federal Withholding Tax information.

- Click the “Submit” button once all your changes are complete.

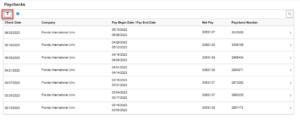

View your Paycheck Online

- Login to MyFIU.

- Navigate to: Employee Self Service > Payroll Tile > Paychecks Tile.

- Select the hyperlink to the check you want to view and a new page will open up with your selected document and make sure your browser pop-up blocker is disabled. (You must have Adobe Acrobat Reader installed to view the PDF document).

- Click on the filter button to expand your date range.

Florida’s Minimum Wage

Social Security and Medicare Tax

Resources:

Social Security Administration

Internal Revenue Service

Direct Deposit Process

FIU requires that all current employees receive salary payments from the university by direct deposit. Direct deposit is a free service that automatically deposits your paycheck into an account at the financial institution of your choice. The financial institution that you choose must be located in the United States and accept Automated Clearing House transactions. Direct deposit will significantly reduce paycheck processing costs incurred by the university. Direct deposit is a secure, convenient, and fast alternative to traditional checks. Direct deposit eliminates the risk of lost or stolen checks and saves you from waiting in lines at the bank. In addition, many banks offer free or low-cost accounts when you use direct deposit.

FIU requires that all current employees receive salary payments from the university by direct deposit. Direct deposit is a free service that automatically deposits your paycheck into an account at the financial institution of your choice. The financial institution that you choose must be located in the United States and accept Automated Clearing House transactions. Direct deposit will significantly reduce paycheck processing costs incurred by the university. Direct deposit is a secure, convenient, and fast alternative to traditional checks. Direct deposit eliminates the risk of lost or stolen checks and saves you from waiting in lines at the bank. In addition, many banks offer free or low-cost accounts when you use direct deposit.

- It’s fast. Your money is available earlier because you don’t have to wait for your paycheck to clear.

- It’s safe. Unlike a paper check, it will never be lost, stolen, or misplaced.

- It’s convenient. You don’t need to go to the Payroll Office to get your check or make a trip to your financial institution to deposit it.

- It’s reliable. Your money will be in the account you specify even if you’re on vacation or out sick.

- It’s free. There is no charge for this service and your financial institution may even offer incentives when you participate in direct deposit.

- It’s easy. Complete the request on-line via the PantherSoft HR Employee Self Service.

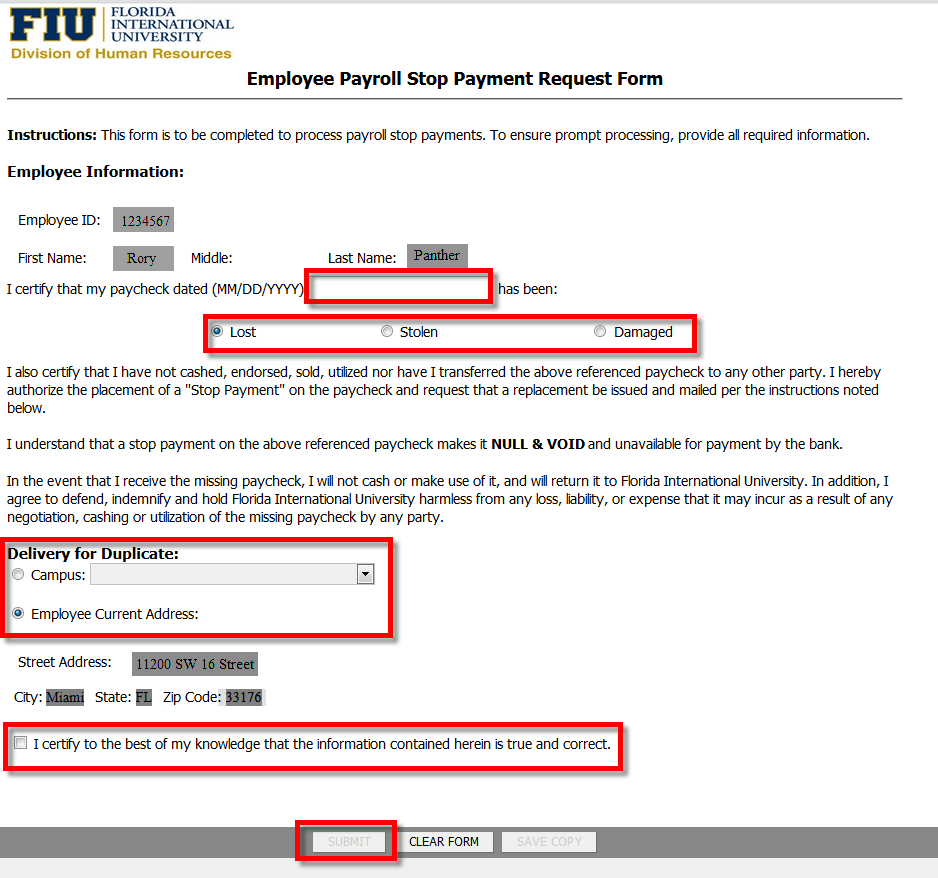

Stop Payment Request Guidelines

Stop payments may be requested if a check has been misplaced, damaged, or has been lost in the mail. For checks that have been lost in the mail, please allow five business days from the issue date of the check before requesting a stop payment in order to give time to the U.S. Postal Service to deliver your check.

Upon receipt of your request, the Payroll Department will validate whether or not the check has been cashed. If the check has not been cashed, the Payroll Department will initiate the stop payment request after five business days from the issue date of the check. The Payroll Department will validate with our financial institution if the stop payment has been completed successfully, five business days from when the stop payment request was submitted to the bank.

Stop payment requests which have been completed successfully will be reissued on the next available off-cycle check run.

The stop payment request form can be submitted via MyFIU.

- Navigation: Employee Self Service > Employee Resources Tile > Employee Forms Tile.

- Select the Payroll Forms tab.

- Select the Employee Stop Payment Request Form.

- The Employee Stop Payment Request Form will auto populate your:

- Employee ID

- First, Middle, and Last Name

- Home or Mailing Address on file

- Enter the date the desired check was originally issued.

- Select the appropriate radio button for the reason that you are requesting a stop payment.

- Delivery for Duplicate defaults to employees home address – campus option is no longer available.

- Click on the check box certifying that the information you are providing is correct.

- Click on the SUBMIT button.

W-2 Form Information

Electronic Form W-2 Tax Statement

As required by the Internal Revenue Service (IRS), FIU must provide all employees with a Form W-2 Wage and Tax Statement each calendar year to be used by the employee in completing their annual Form 1040, 1040A or 1040EZ U.S. Individual Income Tax Return. The Form W-2 Tax Statement details the employee’s wages, tax withholdings, and other important payroll information for the calendar year.

It is recommended for FIU employees to receive their Form W-2 Wage and Tax Statements online by consenting through MyFIU. Please read the notice in its entirety before providing your consent to receive all future Form W-2 Wage and Tax Statements exclusively in electronic format.

Advantages of the electronic Form W-2 Wage and Tax Statement:

- Earlier access to the Form W-2 Tax and Wage Statement.

- The paper Form W-2 Wage and Tax Statement can be lost, delayed or misplaced.

- Accessibility to the electronic Form W-2 Wage and Tax Statement from anywhere the employee has access to a computer.

- Access to the form is securely protected through PantherSoft HR Employee Self Service.

Consent to receive Form W-2 Wage and Tax Statement in electronic format in lieu of paper form:

- Access MyFIU.

- Navigation: Employee Self-Service > Payroll Tile > W-2/W-2c Consent Tile.

- Read the Electronic W-2 Consent Statement, select the “Consent to receive W-2 electronically” check box.

- Click the “Submit” button.

- Verify your identity at the prompt.

- Click Continue.

View W2 statement online (only after consent has been submitted):

- Navigation: Employee Self-Service > Payroll Tile > W-2/W-2c Forms.

- Verify your identity at the prompt.

- Click Submit.

- Select Tax Year from drop down menu.

- Click “View Form” button.

Notice

Employees who consent to receive Form W-2 Wage and Tax Statement online will not receive a paper copy of the Form W-2 Wage and Tax Statement. If an employee does not consent, they will continue to receive a paper copy of the Form W-2 Wage and Tax Statement that will be mailed to their permanent/legal address. The employee can change his/her option and withdraw consent to online delivery by un-checking the consent check box and clicking the “Submit” button.

If consent is withdrawn, it will only be effective for Form W-2 Wage and Tax Statements not yet issued. The provision of an employee’s Form W-2 Wage and Tax Statement by electronic format will stay in place upon the employee’s termination of employment with FIU. Terminated employees will still have access to the PantherSoft HR Employee Self Service to view their Form W-2 Wage and Tax Statement for a period of two years.

All employees should be cognizant that the Form W-2 Wage and Tax Statement, even when provided electronically, should be printed for personal record keeping.

For any additional questions, please contact the Human Resources Service Center at (305) 348-2181.

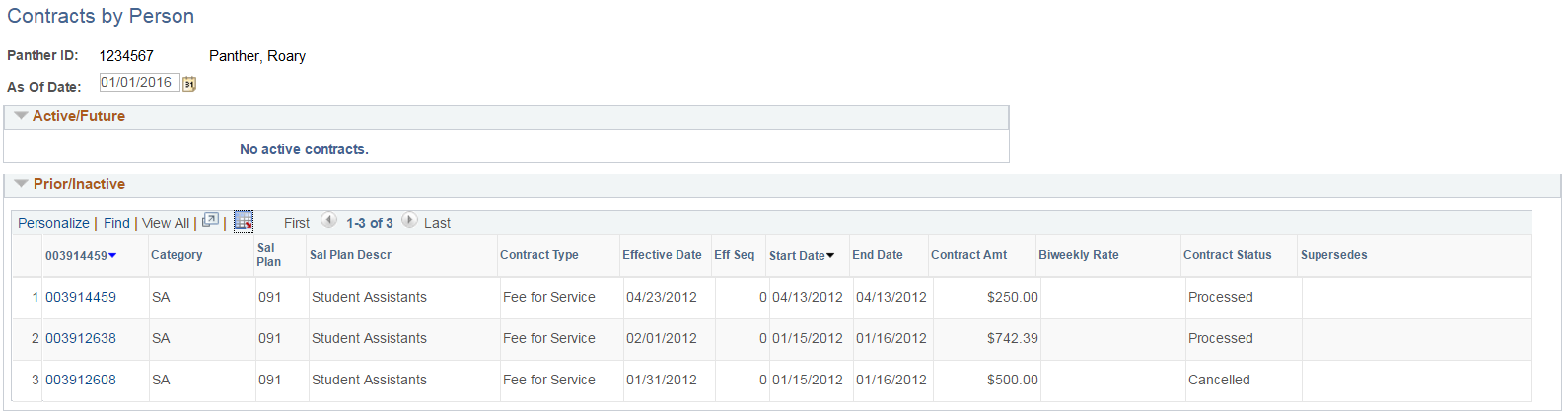

Contract Information

Login to: PantherSoft HR Employee Self Service.

Navigation Path

Human Resources Self Service > Employee Self Service > Contracts > Contracts by Person.

View by Field

- Panther ID: Displays your Panther ID and name (Last, First).

- As of Date: Defaults to today’s date. The active/future contracts will update based on this date. You can change according to the time frame you would like to display.

- Active/Future: This section defaults as expanded and will display active/future contracts based on the as of date.

- Prior/Inactive: This section defaults as collapsed and must be expanded in order to view. This section displays prior/inactive contracts based on the as of date.

- Find: Allows you to enter any contract detail displayed for quick find.

- View All: By default, lists three contracts. When more than three contracts are available, you can click on view all to expand list to all.

- Employee can also use the first/last and back/forward arrows to view contract list.

- Download: Will download contract list to an excel spreadsheet (.xls format).

- Contract Number: Click on hyperlink to view contract details such as funding source, view supporting documents and approval process monitor.

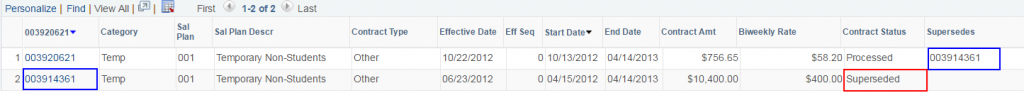

- Contract Status:

- Submitted – Pending one or more approvals.

- Approved – All approvals completed, contract is ready for payroll processing.

- Processed – Payroll has processed the contract for payment.

- Denied – Contract did not pass through the approval process.

- Cancelled – Contract approved, but later cancelled. Click on contract number hyperlink to see contract for cancellation reason.

- Superseded – Changes to processed contract were submitted. New contract replaces superseded contract.

Any questions/concerns regarding the details of a contract should be directed to the corresponding department. A department representative will contact Human Resources/Payroll if needed.

Garnishment Process

A garnishment is a legal order to withhold a portion of an employee’s wages to satisfy a debt. Employee wages can be garnished because of debts to creditors, student loans, or alimony and child support payments. The university does not deduct for voluntary wage assignments.

Types of Garnishments

- Writ of Garnishment and Wage Assignment are garnishments for failure to pay a creditor. They are calculated at 25% of disposable earnings unless a different percentage is negotiated through the court. Disposable earnings are the amount left after legally required deductions are made (such as federal tax deductions and FICA tax deductions).

All writs and wage assignments should be mailed to:

Florida International University

Office of the General Counsel

11200 SW 8th Street

Modesto A. Maidique Campus, PC-511

Miami, FL 33199

Note: Writ of garnishments and wage assignments that are hand delivered by a process server, must be delivered to the Office of the General Counsel in PC-511 at Modesto A. Maidique Campus.

- Child Support, Spousal Support, and Dependent Support are garnishments ordered by a family court. The amount deducted is ordered and determined by the court and cannot be modified by the employer.

- Student Loan Repayment are garnishments for delinquent student loans. The amount deducted is 15% of disposable earnings. Disposable earnings are the amount left after legally required deductions are made.

- Bankruptcy is a garnishment ordered by the United States Bankruptcy Court. The amount deducted is ordered by the court and cannot be modified by the employer.

- Tax Levy is a legal seizure of your wages to collect overdue federal or state taxes. Part of your wages is exempt from levy. To claim exemptions, you must complete and return the Statement of Exemptions and Filing Status to Payroll. If we do not receive the completed Statement of Exemptions and Filing Status, then we are required to use married filing separately and only one personal exemption.

All support orders, student loans, bankruptcy, and tax levy orders should be mailed to:

Florida International University

Division of Human Resources

11200 SW 8th Street

Modesto A. Maidique Campus, PC-224

Miami, FL 33199

Garnishments may not be accepted in an employee’s department.

Cellular Phone Allowance Guidelines

Cellular phones may be necessary for an employee to meet the demands of their job at the university. These employees are entitled to a monthly allowance to cover FIU business related costs. If the department head determines that an employee requires a cellular phone, an ePAF recurring payment request must be submitted through PantherSoft HR Manager Self Service.

Cellular phones may be necessary for an employee to meet the demands of their job at the university. These employees are entitled to a monthly allowance to cover FIU business related costs. If the department head determines that an employee requires a cellular phone, an ePAF recurring payment request must be submitted through PantherSoft HR Manager Self Service.

A cellular phone allowance is granted per the following criteria as outlined in the Cellular Phone Policy:

- Job function requires considerable time outside of assigned office or work area and it is essential to the university that the employee be accessible during those times.

- Job function requires continuous accessibility beyond scheduled or normal working hours (i.e., on-call responsibilities for critical university services).

- Job function requires access to email outside of the office or beyond normal scheduled working hours and it is essential for the university that the employee has the ability to receive and send emails during those times.

If your department head determines that you qualify for a cellular phone allowance, an ePAF recurring payment request must be submitted through PantherSoft HR Manager Self Service.

Any employee who receives an allowance will be required to have the pertinent contact information (i.e., phone number) published or distributed for university business purposes.

Cellular Phone Stipend

Employees receiving a cellular phone allowance are also eligible to receive up to $200.00 maximum allowance on a bi-annual basis towards the purchase of a new phone/data equipment device. In order to be reimbursed for the purchase of the new device, employees must submit a copy of the purchase receipt along with the completed and approved Cellular Phone Allowance/Purchase Request Form.

Incentive Pay

To provide incentive bonuses and rewards in an effort to recruit, reward, and retain quality employees, the university shall consider providing incentive bonuses to non-bargaining unit faculty and employees.

To provide incentive bonuses and rewards in an effort to recruit, reward, and retain quality employees, the university shall consider providing incentive bonuses to non-bargaining unit faculty and employees.

Types of Bonus Payments

Bonus: A one-time monetary award given to an employee in addition to the employee’s regular compensation.

Educational Incentive Award: To encourage professional development and reward employees who acquire a degree, a professional license, or professional certification from an accredited institution or professional organization.

- Associate Degree $500

- Bachelor’s Degree $1,000

- Master’s Degree $1,500

- Doctoral Degree $2,000

- Apprenticeship $500

- Journeyman $750

- Professional Registration or License $1,000

- Professional Certification $750

Operational Excellence Award: To recognize employees who have demonstrated continuous outstanding performance, have made a significant contribution to the department’s mission, and provided consistent support to the department’s objective.

Project Based Bonus: To recognize an employee upon the successful completion of a special project or assignment of significance that is in addition to the employee’s regularly assigned duties. The amount of the project-based pay may not exceed $10,000 or 10% of the employee’s salary whichever is higher.

Sign-on Bonus: As a recruitment incentive, a sign-on bonus may be awarded to a new, highly qualified employee hired into a position considered critical to the university’s operations and strategic mission and/or deemed difficult to fill.

Spot Award: To provide employees with positive feedback, foster continued improvement and reinforce good observable performance after an event or task has been completed, usually without pre-determined goals or performance levels. Bonus amount may not exceed $2,500 in a 12-month period

Variable Compensation Plan: To reward employees based on a pre-approved plan based on employee’s contributions, departmental objectives, revenues generated, targets achieved, and payout schedules.

For further information on the procedures for each type of bonus payment, please refer to the official university Bonus Policy.

Total Rewards Statement

The Total Rewards Statement details the value of each employee’s total compensation and benefits for each calendar year. This statement communicates the university’s commitment and investment in each employee. In addition, the statement includes wages and all salary additives such as bonuses, spot awards, overtime, shift differential pay, lead worker pay, on-call pay, and criminal justice incentive pay. The statement details a wide variety of benefits, including insurance, paid time off, and work-life programs.