Insurance Options

The Benefits Department is proud to serve the university community by providing great benefits and excellent customer service. See below for insurance options.

The Benefits Department is proud to serve the university community by providing great benefits and excellent customer service. See below for insurance options.

Important Notices:

- State benefits enrollment must take place within the first 60 calendar days from the date of hire.

- FIU benefits enrollment must take place within the first 90 calendar days from the date of hire.

State Benefits

- New Employee Benefits Checklist

- Benefits Guide

- Dental Insurance / Comparison

- Health Insurance / Comparison

- Life Insurance

- Vision Insurance

- Reimbursement Accounts

- Supplemental

- Plan Descriptions, Summaries and FAQ

- Shared Savings Program

FIU Benefits

- Pet Insurance

- Life / AD & D

- Long Term Care (within the first 60 Calendar days of hire)

- Long Term Disability

Questions

- How to Enroll with People First? Call 1(866) 663-4735

- Enroll Online

- How to Enroll in Insurance Benefits in People First

- State Group Insurance Resources

- Making changes during the year

- Spouse Program Election Form

- New Employee Benefits Presentation Video

Retirement Options

State Retirement Plans

As a new State employee, in a benefits-earning position, you must choose one of three retirement plans available to employees eligible for the State University System Optional Retirement Program (SUSORP). All three plans are funded by you and your employer and offer important benefits. See a comparison of all three plans.

Based on your position type, you may be eligible for the following plans:

- FRS Pension – A traditional defined benefit retirement plan designed to pay you a set amount for your lifetime, after you have met minimum vesting and retirement requirements.

- FRS Investment – A defined contribution retirement plan where the benefit depends on the amount of money contributed to an employee’s account and its growth over time. Employees decide how to allocate the money in your account among the available investment funds.

- State University System Optional Retirement Program (SUSORP) – A defined contribution retirement plan where the benefit depends on the amount of money contributed to an employee’s account and its growth over time. Employees decide how to allocate the money in your account among the available investment funds.

Who is eligible?

Who is eligible?

- Administrative employees are eligible for FRS Pension Plan, FRS Investment Plan, Optional Retirement Program (ORP), and Voluntary Retirement Plans (403b/457).

- Executive Service employees are eligible for FRS Pension Plan, FRS Investment Plan, Optional Retirement Program (ORP), and Voluntary Retirement Plans (403b/457).

- Faculty members are eligible for FRS Pension Plan, FRS Investment Plan, Optional Retirement Program (ORP), and Voluntary Retirement Plans(403b/457).

- Staff employees are eligible for FRS Pension Plan, FRS Investment Plan, and Voluntary Retirement Plans (403b/457).

Additional Resources

- New Employee Retirement Presentation

- SUSORP Provider List

- MyFRS Financial Guidance Line (866) 446-9377

- Loans/Hardship Withdrawals – Loans and hardship withdrawals are not permitted under FRS/SUSORP plans. If you have a 403(b) or 457 deferred compensation plan, these plans may offer loan options. Requests for active employees are processed through My Retirement Manager.

Enrollment

Plan Funding and Contribution Limits

Employee Contributions. Based on Florida law, employees contribute 3% of their pretax salary, beginning with their first paycheck, regardless of which retirement plan they choose.

Employer Contributions. Employer contributions are equal to a percentage of the member’s gross monthly salary. The percentage is based on the member’s membership class and is determined by the Florida Legislature and respective plan provisions.

Contribution Limits. As required by Section 121.71(2), Florida Statutes, employee contributions are treated for tax purposes as employer-paid employee contributions (commonly called an employer pick-up) under Internal Revenue Code Section 414(h)(2). Employee contributions are limited by Section 415 of the Internal Revenue Code.

Salaries Exceeding Federal Limits. Federal law, under section 401(a)(17) of the Internal Revenue Code, limits the amount of annual salary that may be applied towards retirement under a qualified retirement plan. IRC Section 415 requires the limits to be adjusted annually for cost-of-living increases.

For further reference, review the MyFRS Plan Funding section (FRS Plans) and the State University System Optional Retirement Program Plan Document (SUSORP Plan).

Voluntary Savings Plan (403b & 457 plans)

FIU offers a series of Voluntary Savings Plans that provide you with the opportunity to plan for a secure financial future by maximizing your savings for retirement on a tax advantaged basis.

Review the different plan options and investment companies available at FIU:

- 403(b) Pretax Plan – Contributions are taken out of your pay before it is taxed, which lowers your taxable income. You will pay taxes on distributions.

- Roth After-Tax 403(b) Plan – Contributions are taken out of your paycheck after your income is taxed. This option provides tax-free growth and tax-free distributions.

- 457 Deferred Compensation Plan (Pretax) – Contributions are taken out of your pay before it is taxed, which lowers your taxable income. You will pay taxes on distributions.

- Plan Comparison Chart and Provider Contact Information

Eligibility and Enrollment

Administrative, Executive Service, Faculty, Staff, and Temporary (OPS) employees are all eligible to participate in the voluntary savings plans.

Initial enrollment, for both 403(b) and 457 plans, requires employees to contact a provider company to open an account. Once the account is established, you can start and update contributions as needed.

Enroll and update your 457 deferred compensation plan contributions:

Please note that it may take several weeks to stop or change your 457 payroll deductions. To begin this process, please contact the Bureau of Deferred Compensation’s office at (877) 299-8002.

Enroll and update your 403(b) voluntary savings plan contributions via Panther Soft:

- Access Panther Soft HR Employee Self Service.

- Enter your FIU credentials to log in.

- Click the Employee tab.

- Navigate to: Human Resources Self Service > Employee Self Service > Employee Forms

- Click on Benefit Forms.

- Select Retirement Voluntary Contribution.

- Important note: Ensure your account is updated prior to starting deductions. Failure to complete the retirement account provider(s) application(s) will result in your elected amount to NOT start deducting from your paycheck.

IRS 2024 Limits for Voluntary Contributions

| Plan/Criteria | 403(b) Pre and Post tax | 457 pre-tax |

|---|---|---|

| Under age 50 | $23,000.00 | $23,000.00 |

| Age 50 and over | $30,500.00 | $30,500.00 |

The IRS sets limits on the amount of money that can be contributed to your voluntary retirement plan(s).

Additional Resources

- Provider Contact List, & Plan Comparison Chart for 403(b) & 457 Voluntary Plans

- FIU 403(b) Plan Document

- Bureau of Deferred Compensation

- Loans/Hardships Withdrawals – requests for active employees are processed through My Retirement Manager.

- My Retirement Manager – Retirement Manager is a convenient, secure, web-based access point from which you can manage your FIU 403(b) plan loan and/or hardship distribution requests. As a reminder, the FIU 403(b) plan accounts do not include the State of Florida retirement plans such as FRS Pension, FRS Investment or State University System Optional Retirement Program (SUSORP). Please note that account specific questions related to a particular provider should still be addressed directly to that provider. You can find a list of providers on our FIU HR website. For further assistance, contact the Retirement Manager Support Line at 1-866-294-7950.

- My Retirement Manager Guide

- FIU 403(b) Plan Committee

- 02/02/2024-FIU 403(b) Plan Committee Meeting

- 12/18/2023-FIU 403(b) Plan Committee Meeting

- 11/21/2023-FIU 403(b) Plan Committee Meeting

- 10/27/2023-FIU 403(b) Plan Committee Meeting

- 08/31/2023-FIU 403(b) Plan Committee Meeting

- 08/25/2023-FIU 403(b) Plan Committee Meeting- Provider Presentations

- 08/24/2023-FIU 403(b) Plan Committee Meeting- Provider Presentations

- 07/20/2023-FIU 403(b) Plan Committee Meeting

- 04/12/2023-FIU 403(b) Plan Committee Meeting

- 12/16/2021-FIU 403(b) Plan Committee Meeting

- 11/16/2021-FIU 403(b) Plan Committee Meeting

- 09/15/2021-FIU 403(b) Plan Committee Meeting

- 05/08/2020-FIU 403(b) Plan Committee Meeting

Upcoming Retirement Webinars/Workshops

Life Events

Life Events consist of change in family or employment status. Examples of such events may include: leave of absence, marital status change, address change, death in the family, preparing for retirement, among others. Please visit the Life Events page for more information.

Leave Accruals

Sick Leave and Vacation Leave Accrual

Eligible employees accrue vacation and sick leave balance to be used in accordance with the Vacation Leave policy and Sick Leave Policy, respectively. In addition, employees should refer to their respective Collective Bargaining Agreement (CBA) for sick leave accrual and time use policies.

Sick / Catastrophic Leave Pool

Sick Leave Pool

Participation in the Sick Leave Pool (SLP) shall be voluntary on the part of eligible employees. Eligibility in the SLP is extended to employees after completion of six months of employment with the university, provided that a minimum of forty hours of sick and/or vacation leave has been accrued by full-time employees, or twenty hours by part-time employees. Full-time employees contribute eight hours of leave and part-time employees contribute four hours of leave to the SLP on a yearly basis. Participating employees may terminate their membership in the SLP at any time by notifying the SLP Administrator.

Sick Leave Pool hours shall be granted only for the employee’s personal illness, injury, accident, or exposure to a contagious disease. Personal illness shall include, but not limited to disabilities which are the result of or contributed to by medical conditions (including those complications related to pregnancy or childbirth), surgery and recovery.

Participating employees must have depleted all their accrued leave hours before SLP hours will be granted. A participating full-time (1.0 FTE) employee may withdraw a maximum of 480 hours from the SLP during any twelve month period. Part-time employees may withdraw a maximum of 240 hours from the SLP during any twelve month period.

Employees retrieving SLP hours are required to follow the Medical Leave of absence process. Upon receipt of required medical documentation, the SLP Administrator who is responsible for the oversight of the program, will present the request to the SLP Committee which consists of six representative employees; two administrative employees, two faculty members and two staff members. A vote of a minimum of four is needed to grant hours to the employee.

Sick Leave Pool Membership Process

An employee has two opportunities in a year in which to join the SPL program. The first is during the Annual Open Enrollment or at the time the employee reaches their initial six months of service.

- During the Annual Open Enrollment or at the six month anniversary mark, eligible employees will receive via email (or if no email available, a hard copy) notice regarding the program and membership application.

- If the employee is interested in joining, the employee should complete the SPL Membership Application and submit it to the SPL Administrator in HR Benefits.

- Upon receipt, the SLP Administration will verify the employee’s eligibility to join the pool.

- If the employee is ineligible, the form is returned to the employee with a note on the application.

- If approved, a letter is generated and the approval letter along with a copy of the policy forwarded to the employee (interoffice mail) for his/her files. Deduction of membership hours against the employee’s accrued time is executed within two payroll periods.

- This membership is valid for one year. In order to renew and keep the membership active, a notification will be sent of the upcoming annual deduction of half the hours that were required to join the SLP.

- The employee may terminate the membership by sending an email to the Sick Leave Pool Administrator at hrleaves@fiu.edu.

Catastrophic Pool

The Catastrophic Pool is a voluntary program designed to allow eligible employees to donate sick leave hours directly from one employee to another employee who has exhausted their leave balances including sick, vacation, and compensatory time. Employees receiving Catastrophic Pool hours (donations) are required to follow the Medical Leave of absence process. Unlike the Sick Leave Pool Program, this program allows the donation of hours not only for the employee but for the employee’s immediate family member. For the purpose of this policy, immediate family is defined as spouse, child(ren) (including foster and stepchildren), parents (including stepparents) and grandparents.

Catastrophic Pool Guidelines

The dean or director of the department where the affected employee works will need to coordinate the request, donation of hours, and secure approval from their respective vice president/provost by completing the Catastrophic Approval Memo. The coordinator must prepare a spreadsheet with the names and amount of hours donated by each employee. All donations of hours will need to be coordinated through the dean or director’s office. Once vice president/provost approval is secured, the employee that is donating the hours will need to complete the Donation Hours Memo authorizing the transfer of sick leave hours.

The dean or director will need to submit to Human Resources, PC 224, the following documents:

- Copy of the Catastrophic Approval Memo approved by the vice president/provost.

- Individual copies of the Donation Hours Memos signed by the donating employees.

- The spreadsheet with the panther ID, names, amount of hours donated by each employee and total amount of all donated hours.

Perks

FIU is a great place to work. The Employee Perks & Services Program is just one of many benefits offered at FIU. As a benefit of your employment with the university, you have access to discounts from hundreds of local and national vendors. Receiving your discounts is easy. Most vendors just need to see your FIU One ID card or offer an online coupon code. However, be sure to read each discount carefully, as they may not apply to everyone or have specific requirements. We thank you for making FIU Worlds Ahead!

Visit the Perks Page to view all the available Employee Perks & Services.

Tuition Waiver

The employee tuition waiver benefit allows eligible employees and their dependents to have tuition waived up to three times per year: spring semester, summer semester, and fall semester. The available credits are a pool to be split between the employee and dependents. The waiver covers up to six credits for employees and up to 10 credits per semester for dependents. If both employee and dependent are using the waiver, no more than six of the ten available credits may be used by the employee. The available credits are a pool to be split between the employee and dependent.

Who is eligible?

- Full time administrative, staff and faculty working 40 hours a week (1.0 FTE)

- Eligible dependents constitute legal spouse and dependent children. Dependent children remain eligible through the end of the calendar year in which they turn age 24.

How and when do I submit a tuition waiver?

- Register for classes in the available semester.

- Submit a Tuition Waiver – In order to avoid late payment fees, tuition waivers should be submitted before the last day to pay to allow for sufficient approval and processing time.

How does the approval process work?

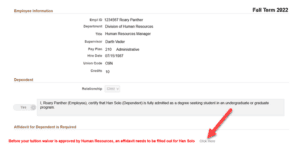

- For employees, the supervisor must first validate and approve the Tuition Waiver submission online, which will then automatically route to Human Resources and Student Financials for approval.

- For dependents, the Tuition Waiver is approved by Human Resources then Student Financials.

Before Human Resources can approve a tuition waiver for your dependent, some supplemental documents are required.

- Dependent child: The employee must submit a copy of their dependent’s birth certificate and if the dependent is claimed on the tax return, a copy of first page of the tax return, or a tax return transcript is required.

- Dependent spouse: The employee must submit a copy of the marriage certificate and if their taxes are filed jointly, a copy of first page of the tax return, or a tax return transcript is required.

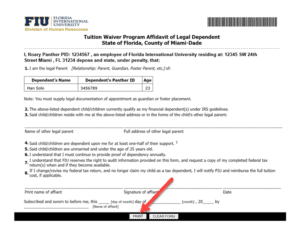

In addition, for dependent spouse and child, every third semester an affidavit must be submitted. To access the affidavit, please follow the instructions below:

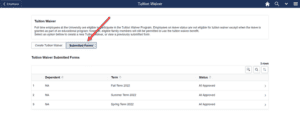

- Login to myhr.fiu.edu using your employee credentials.

- Once logged into your employee profile, click on the Tuition Waiver tab.

- Click under Submitted Forms and that will show you all the tuition waiver submissions.

- Click the Tuition Waiver Term you want review, and it should look like the picture below.

- To open the affidavit, press on the Click Here button at the end of the red text as shown above.

- Click Print and it will allow you to choose your printer or save it as a PDF to complete it electronically.

-

- To submit the documents, you may upload it using the DHR Imports tool:https://imagenowweb.fiu.edu/imagenowforms/fs?form=HR_Import

- Click Print and it will allow you to choose your printer or save it as a PDF to complete it electronically.

Are any programs excluded?

- Tuition Waivers do not apply to the College of Law and the Herbert Wertheim College of Medicine.

- Market Rate programs and Self-Supporting for dependents are also excluded.

What are the policy details?

- For specific exclusions and limitations of the Tuition Waiver Program, please refer to the policy.

Questions/Contact Information

- Human Resources Customer Service Center

- Phone number: (305) 348-2181

- Email: hrservice@fiu.edu

Scholarships

Aligned with our university’s mission, fostering an environment where our workforce can expand their knowledge, skills and opportunities to innovate is at the core of what we do – Our people are everything!

Berta D. Villares Book Scholarship

Berta D. Villares Book Scholarship

The Berta D. Villares Book Scholarship will provide eligible faculty/staff members currently using the FIU Tuition Waiver, a one-time $75 cash award based on established criteria and available funding. The award is designed to help offset the expenses associated with the purchase of required course textbooks.

Eligibility

Eligible scholarship recipients for the Berta D. Villares Book Scholarship must be:

1) A FIU benefits-eligible faculty/staff regularly employed for a minimum of one year. (Only faculty/staff members using the FIU Tuition Waiver are eligible for this award, not their dependents.)

2) Currently enrolled as a degree-seeking student pursuing their first bachelor’s, master’s, or doctoral degree.

3) Completed a minimum of 90 credits toward a bachelor’s, 20 credits toward a master’s, or 45 credits toward a doctoral degree at time of application submission.

3) Have a minimum cumulative GPA of 3.00 or better.

Applications for the Berta D. Villares Book Scholarship are accepted during the Fall and Spring semesters. Applications and deadlines will be announced in our HR News & Updates e-newsletters.

Generations Ahead Scholarship-Faculty/Staff

Generations Ahead Scholarship – Faculty/Staff

The Generations Ahead Scholarship for Faculty/Staff is sponsored by the Gabor Agency and is another way to demonstrate our combined appreciation for our valued faculty and staff.

This scholarship is designed for FIU’s benefits-eligible faculty and staff who are also enrolled as full-time students at FIU. The scholarship is a one-time awarding of either $3,000 for eligible Graduates or $2,000 for eligible Undergraduates.

Eligibility

Eligible recipients for the Generations Ahead Scholarship must be:

- An FIU full-time, benefits-eligible faculty/staff regularly employed for a minimum of one year.

- Be currently enrolled as a degree-seeking, full-time student at FIU, taking a minimum of 12 credits as an undergraduate or 9 credits as a graduate student.

- Have a minimum cumulative GPA of 2.50 or better as an undergraduate or 3.0 as a graduate

Applications for the Generations Ahead Scholarship are accepted each fall semester Applications and deadlines will be announced in our HR News & Updates e-newsletters.

Generations Ahead Scholarship- Dependents of Faculty/Staff

Generations Ahead Scholarship – Dependents of Faculty/Staff

The Generations Ahead Scholarship for dependents (son/daughter) of faculty/staff is sponsored by the Gabor Agency and is another way to demonstrate our combined appreciation for our valued faculty and staff.

This scholarship is designed for dependents of FIU’s benefits-eligible faculty and staff. The scholarship is a one time awarding of either $3,000 for eligible Graduates and $2,000 for eligible Undergraduates.

Eligibility

Eligible recipients for the Generations Ahead Scholarship must be:

- A dependent (son/daughter) of an FIU full-time, benefits-eligible faculty/staff member regularly employed for a minimum of one year.

- Be currently enrolled as a degree-seeking, full-time student at FIU, taking a minimum of 12 credits as an undergraduate or 9 credits as a graduate student.

- Have a minimum cumulative GPA of 2.50 or better as an undergraduate or 3.0 as a graduate

Applications for the Generations Ahead Scholarship are accepted each fall semester Applications and deadlines will be announced in our HR News & Updates e-newsletters.

Temporary Employee Benefits

Insurance Benefits

The State of Florida offers health insurance benefits to OPS (variable hour/ temporary) employees when they meet specific eligibility criteria. Benefits eligibility criteria is determined by People First, plan administrator for the State Group Insurance.

Resources:

- Temporary Employee Benefits Checklist

- Benefits Overview for OPS Temporary Employees Presentation Video

- Eligibility and Enrollment

- Benefits Guide

- How to Enroll in Insurance Benefits in People First

FICA Alternative Plan

The FICA Alternative Plan is a qualified savings plan that allows temporary employees to contribute a percentage of their before-tax wages to investment accounts. The employee has the ability to manage his/her own account.

As of February 1, 2009, all temporary, part-time, and seasonal FIU employees who are not covered by the State Retirement System will participate in a qualified savings plan, administered through Bencor, Inc. In lieu of paying 6.2% of after-tax wages to Social Security, eligible employees will contribute 7.5% of their before-tax wages to an investment account under their name (Medicare contributions of 1.45% will continue to be withheld and matched by FIU). All temporary eligible employees, excluding students, are automatically enrolled in this plan.

- Informational Video

- Plan Overview

- FICA Plan – FAQs

- Easy Access to your FICA account

- Spousal Consent Form

- Bencor Financial Wellness Site

Voluntary Savings Plan

FIU offers a series of Voluntary Savings Plans that provide you with the opportunity to plan for a secure financial future by maximizing your savings for retirement on a tax advantaged basis.

Review the different plan options and investment companies available at FIU:

- 403(b) Pretax Plan – Contributions are taken out of your pay before it is taxed, which lowers your taxable income. You will pay taxes on distributions.

- Roth After-Tax 403(b) Plan – Contributions are taken out of your paycheck after your income is taxed. This option provides tax-free growth and tax-free distributions.

- 457 Deferred Compensation Plan (Pretax) – Contributions are taken out of your pay before it is taxed, which lowers your taxable income. You will pay taxes on distributions.

- Plan Comparison Chart and Provider Contact Information

9 over 12 Salary Deferral

9 over 12 month Deferred Earnings Program (DEP)

ANNUAL ENROLLMENT PERIOD: April – August

Faculty members who have 9-month appointments are automatically paid their annual salary over the term of the contract which is usually 19 bi-weekly payments beginning with the payroll period coinciding with the appointment start date.

The 9 over 12 Deferred Earnings Program (DEP) provides 9-month faculty an alternative option to receive payment of their annual salary over a 12 month period. This method of payment is available on an optional basis only. It is necessary to receive authorization from the faculty member to distribute the annual salary over a 12 month payroll cycle. Upon authorization, beginning with the payroll period coinciding with the appointment start date, 26 bi-weekly payments will be paid to faculty members electing this option.

Enrollment Process

The selected DEP payment option will remain active until a new authorization form is submitted through PantherSoft HR Employee Self Service and a different payment cycle is selected. All 9-month faculty members will have the opportunity to select this payment option during the 9 over 12 Deferred Earnings Program (DEP) Enrollment period that begins April through August. New faculty members will exercise their options when completing the sign-on documents.

- Login to PantherSoft HR Employee Self Service.

- Navigate to: Human Resources Self Service > Employee Self Service > Employee Resources > Employee Forms.

- Select Benefit Forms > Deferred Earnings Program.

- Elect the corresponding option.

- Click the “Submit” button once all your changes are complete.

To review the estimated calculation for your Deferred and Gross Earnings, please use the 9 over 12 Deferred Earnings Program (DEP) calculator.

Important note: the estimated calculation is based on the full 9 month salary with the total of 19 pay checks.

Open Enrollment

The Division of State Group Insurance (DSGI) provides an Open Enrollment period each year to give eligible faculty, staff, temporary (OPS) employees and adjuncts an opportunity to enroll, change, add, or drop coverage and/or dependents from their benefits plans without a Qualified Status Change (QSC*) occurring. Any changes made during Open Enrollment go into effect on January 1st of the following year.

Open Enrollment for Plan Year 2024 begins Monday, October 16, 2023 at 8 am (EST) and will promptly end on Friday, November 3, 2023 at 6 pm (EST). Attend the FIU’s Benefit Fairs at MMC Oct. 16, 2023 & BBC Oct. 17, 2023. To learn more about what’s new for open enrollment, visit: https://www.mybenefits.myflorida.com.

We highly recommend attending the following events:

Questions? Contact us at Benefits@fiu.edu.